Features & Benefits

Enhanced with the latest in payments technology.

Put your trust in our platform

Velo provides the most comprehensive payout solution to exceed the needs of the marketplace today and future proof payments for years to come. With an easy to use, mobile-first design, coupled with an additional layer of transparency and data, Velo provides a solution that can save users valuable time and resources.

|

Payment rail agnostic |

|

Domestic and cross border |

|

Safe and secure |

Frictionless payments

The Velo platform removes client burden. Once onboarded, payments are made to a payee, not a bank account. Any change to payment instructions is managed by the payee. Client's pay payees not accounts.

Simple onboarding

We have a streamlined interface for payees to onboard and provide their payment preferences so they can be paid. Onboarding includes KYC/KYB checks and multiple automated processes including screening against OFAC, Sanctions and AML lists.

Real-time reporting

The Velo platform supports on-demand reporting that can be generated in our customer facing Portals. All information related to payees and payments can be queried by our API.

Velo provides compliant payments processing, optionally handling compliance checks and data sovereignty wherever we operate, including compliance with GDPR and other data privacy requirements.

The best tool for clients

The Velo Platform uses the latest technology to save clients time and resources. The platform cuts manual processes and costs by reducing errors and exceptions with beneficiary directed payments. In addition, it provides all-party access to unified real-time payment information, increasing self-help capabilities while reducing customer service needs.

|

Client hierarchy |

|

Automatic funding |

|

Real-time data |

Features for clients

Simple and quick integration

Velo offers multiple integration avenues (APIs, Portals) to help our clients leverage the platform rapidly.

Payout / Payment bundling

The Velo Platform can initiate one payment or tens of thousands of payments. Payments can be grouped into a single ‘Payout’ making a large volume of payments easier to manage.

Payment tracking

The Payment Tracker provides a very granular real-time view into the progression of each payment with date and time stamps. It provides all information available from payment rails positive acknowledgment throughout the life cycle of the transaction.

Transaction monitoring

The Velo Platform has Transaction Monitoring built-in to monitor customer transactions, including assessing customer information and payments to provide a complete picture of customer activity.

Easy recipient onboarding

Velo reduces your recipient onboarding burden and performs the required sanction screening. Velo utilizes the industry leading compliance technology to monitor transactions and screen all recipients against OFAC, Sanctions & PEP lists.

Proactive and event-driven notifications

The Velo solution monitors events in real-time to identify items that need your attention, such as, additional funding required, pre-defined thresholds met, etc.

Global operations team

Velo maintains a global team of payment experts to react to any delivery errors and answer your recipients' questions.

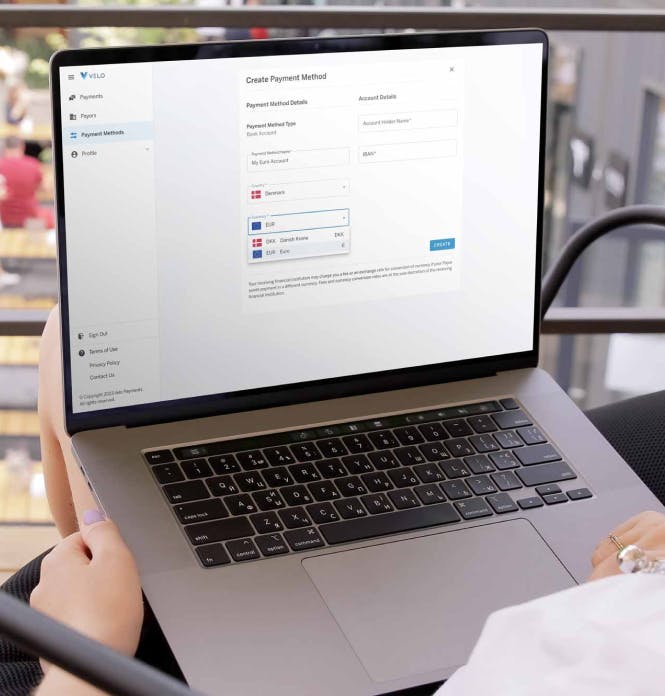

Enable your payees

The Velo Platform allows recipients the freedom to onboard themselves and choose where their payments go. With an intuitive UI, beneficiaries can manage their profiles and track payment lifecycles.

|

Multiple payment methods |

|

Currency choice |

|

Two-factor authentication security |

Features for payees

Digital onboarding

Payee onboarding is completed digitally which minimizes errors and ensures correct data. A streamlined UX for Payee onboarding creates payment preferences and validates information, all prior to payment.

Track payment progress

Payors and payees have real time visibility to payment status. More transparency, less friction, less resources needed to answer the question of ‘Where’s my payment?”. Payees get push notifications by SMS and/or email upon payment initiation and can track the detail of the payment within the Payee Portal.

Self-management portal

Recipients manage their profile and payment destination preferences via the secure portal.

Branded payment notifications

Payees receive Payor-specific notifications enabling them to quickly identify messages from each Payor.

Two-factor Authentication (2FA) security

Payee Portal access is secured by two-factor authentication, established by the payee during onboarding. The secondary factor for access utilizes a one-time password (OTP) sent to the users’ registered mobile phone.